Rising Individual Health Insurance Premiums and Lower Subsidies

Why So Many Are Feeling the Impact

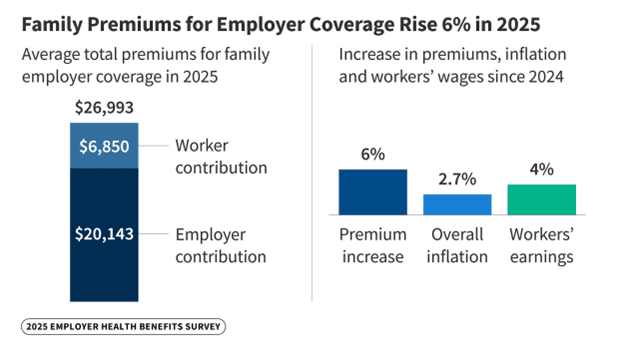

Many individuals and families are experiencing higher health insurance premiums while also seeing reduced subsidy eligibility. This combination has made coverage more challenging across income levels.

Why Subsidies Are Declining for Some

Subsidy eligibility is determined by:

- Household income

- Federal poverty level thresholds

- Regional plan pricing

Even modest income increases can result in reduced or eliminated subsidies, leading to higher out-of-pocket costs.

Who Is Most Affected

- Middle-income households

- Self-employed individuals

- Early retirees

- Younger professionals with rising incomes

The Broader Impact

Higher premiums and deductibles can affect budgeting, savings, and long-term financial planning—not just healthcare decisions.

Navigating a Changing Landscape

Understanding income thresholds, plan designs, and cost-sharing structures is essential when selecting coverage.

If rising premiums or changing subsidies are affecting your health insurance decisions, we are here to help explain your options.

Visit www.insurancesolutionsusa.com or call 817-756-1442 to speak with a licensed insurance professional.

Categories: Blog